Situation

Client is an affordable housing property management agency whose residents get paid for housing from several funding providers. These providers send weekly receipts in pdf format, reflecting amounts paid for each client on each date over the past week. More often than not, funders make mistakes in billing, missing payments for days that are supposed to be billed for certain clients. The agency assigns one then two staff members, who are already overloaded with other administrative tasks, to read through these receipts, compare the dates each client is paid with the dates each client is active in the funding program, flag unpaid days for each client, and contact the providers to correct the payment. Once a provider transfers a missed payment, it also sends a receipt reflecting the correction, which needs to be updated to the company’s record, which has been an Excel sheet.

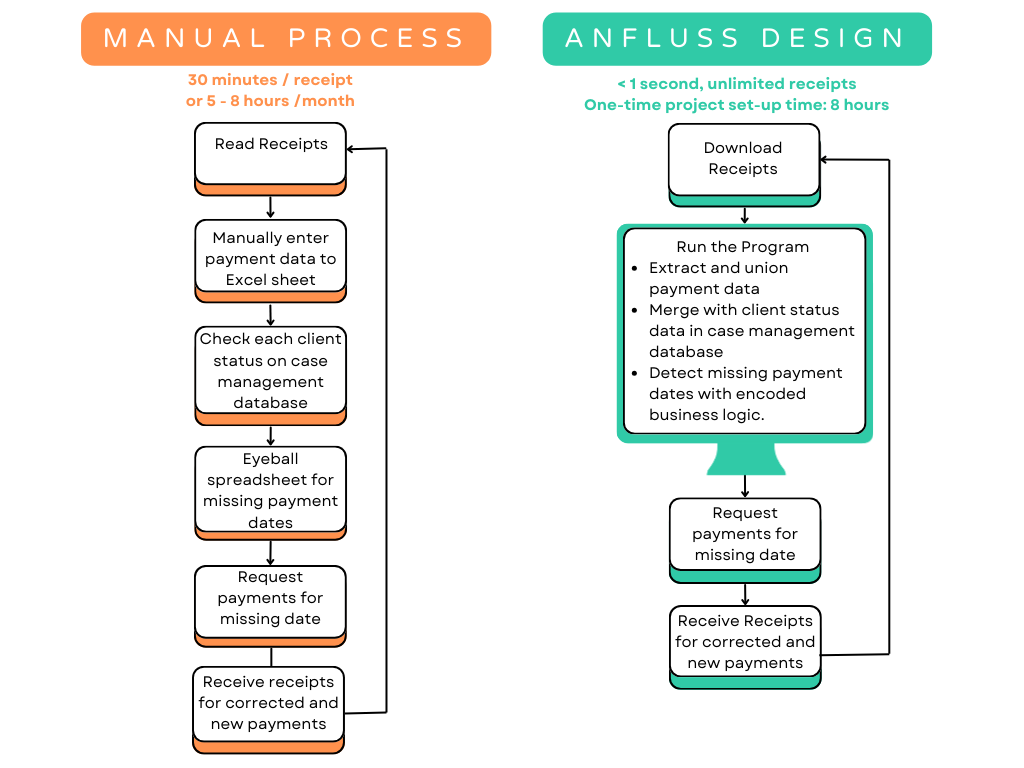

The tasks of reading receipts, manually entering data to the Excel sheet, eyeballing for days with missing payment for each client, and updating corrected payments soon prove extremely taxing, time-consuming, and even unhealthy for the assigned staff members. Suppose it takes 30 minutes to eyeball through each receipt, manually transfer data to an Excel sheet, and weed out missing payment days, whereas the agency receives 10 to 15 receipts per month, then every month the agency would lose 5 to 8 hours just for this manual task that was shared between two staff members, among other responsibilities. That is not to mention 50 receipts in back log.

With great concern for the staff members’ mental health and for the company’s efficiency, Anfluss takes on the task to design a tool to help manage billings.

Approach

The objective is to minimize the amount of time eyeballing receipts, entering data manually, and flagging missing dates.

No more reading and manual data entry

Noticing that each provider’s receipts came with distinctive format, Anfluss team wrote a Python script to read pdfs, extract data from each format, and union data for all clients from all providers into one payment data frame.

From eyeballing to smart detection

The client names from the payment data frame is then merged with the company’s case management database for extra information on entry and exit dates, which determine the timespan the clients should receive payments.

Then Anfluss team program the following logic:

- Individualized Tracking: We grouped the data by client, allowing us to process each client’s payment history individually. For each client, we determined the earliest billing start date and the latest billing end date, effectively setting the boundaries for our payment calendar.

- The “earliest billing start date” is either the date the client enrolled in the program (according to the case management system), or the default date that reflects the date the agency starts its own billing operation. If a client starts the program before this default date, the default date is used as the earliest billing start date.

- The “latest billing end date” is either the latest date the receipt mentioning that client is issued, or the last date the client is active in the program.

- Payment Monitoring: For each day within the defined billing period, we checked whether a payment had been made to the client. If the day did not coincide with a payment date, we flagged it as an “unpaid date” for that client.

- Results Compilation: Finally, we compiled a list of all unpaid dates for each client, along with their service provider. This information was then presented in a clean, structured format that the client could easily use to follow up on any outstanding payments.

The total one-time project set-up time was about 8 hours, as much time as the agency spent each month just on this operation.

Results

The final output was a detailed dataset that enabled our client to efficiently track unpaid days for each client, thereby improving their ability to manage billing and ensure timely payments. This solution has already helped them streamline their financial oversight and address gaps in their payment collection process.

The program is then packaged into a user-friendly app that can take in new receipts, rerun, and update the outstanding payment sheet. The staff member tasked with billing can update weekly, daily, or any time they receive new receipts.

After Anfluss’s solution was launched, the staff member could simply download receipts and rerun the program in mere seconds. Not only are time and money saved, but the staff members also enjoy less stress and can focus on more meaningful tasks.

Discover more from Anfluss

Subscribe to get the latest posts to your email.